Investing in the stock market can be really exciting, but it can also feel a bit overwhelming at times. When you trade in stocks, emotions often play a significant role in decision-making. Whether it’s the happiness of a winning streak or the anxiety of a sudden market drop, emotions can cloud judgment and lead to uncalculated risks. For Indian investors, where market volatility is common, staying focused and making data-driven decisions is crucial.

Tools like a brokerage calculator can help streamline trading strategies by ensuring that costs and fees are factored into every transaction. Let’s explore how you can avoid emotional pitfalls when you trade in stocks and make informed choices using reliable strategies and tools like a brokerage calculator.

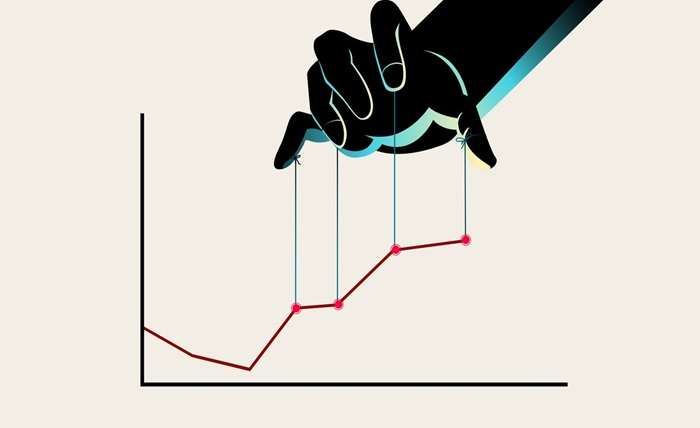

The impact of emotions on stock trading

Emotions such as fear, greed, and overconfidence can significantly affect trading decisions.

- Fear of losing money: Fear is a natural reaction when markets turn volatile. Investors often panic-sell, leading to losses that could have been avoided by staying invested.

- Profit-driven decisions: On the flip side, the prospect of quick gains can lead to overtrading or investing in high-risk stocks without sufficient research.

- Overconfidence in strategies: Overconfidence may lead investors to ignore market signals or diversify less, increasing the risk of financial losses.

These emotional reactions can derail long-term financial planning, especially when you aim to trade in stocks systematically.

Strategies to avoid emotional trading

Here are actionable strategies to keep emotions in check when trading in stocks.

1. Set clear financial goals

Having predefined financial objectives helps you focus on the bigger picture rather than reacting impulsively to market fluctuations. Whether your goal is wealth creation, retirement planning, or short-term profits, aligning your trades with these objectives can prevent rash decisions.

2. Stick to a trading plan

A well-structured trading plan acts as a guide for every transaction. It includes parameters such as:

- Investment amount

- Risk tolerance

- Target returns

- Stop-loss levels

When combined with the insights provided by a brokerage calculator, a trading plan ensures your trades are calculated and aligned with your financial strategy.

3. Diversify your portfolio

Diversification helps spread risk across various sectors and asset classes, reducing the emotional impact of a loss in any single investment. Indian investors often balance equities with mutual funds, bonds, and other instruments to maintain a stable portfolio.

4. Automate your trades

Automated trading options like Systematic Investment Plans (SIPs) for equities can help remove emotional biases. Investing a fixed amount at regular intervals encourages disciplined investment practices, regardless of market fluctuations.

5. Focus on data and research

Relying on data-driven insights can help counteract emotional tendencies. Look for:

- Stock performance history

- Market trends

- Analyst recommendations

Additionally, tools like brokerage calculators offer clarity on cost implications, helping you make rational trading decisions.

How does a brokerage calculator simplify trading?

A brokerage calculator eliminates guesswork and ensures precision. Here’s how it benefits traders in India:

- Transparency in fees: It provides a detailed breakdown of brokerage charges, transaction fees, and other costs involved in trading.

- Quick decision-making: The tool speeds up calculations, allowing traders to focus on analysing stock performance.

- Budget control: By knowing the exact costs beforehand, investors can allocate funds wisely and avoid overspending.

- Scenario analysis: Traders can experiment with different transaction volumes or stock prices to assess potential returns.

Whether you’re a beginner or an experienced investor, using a brokerage calculator can significantly enhance your ability to trade in stocks with confidence.

Common mistakes to avoid when trading

To minimise emotional trading, steer clear of these common errors:

- Chasing market trends: Investing in popular or trending stocks without research can lead to losses.

- Ignoring stop-loss orders: Failing to set stop-loss levels may result in substantial financial setbacks during market downturns.

- Neglecting cost calculations: Skipping the use of a brokerage calculator often leads to underestimating expenses, impacting profitability.

Avoiding these mistakes requires discipline, patience, and the use of reliable tools to streamline your trading process.

Achieve precision in trading with the right tools

When you trade in stocks, emotions are inevitable, but they don’t have to dictate your decisions. By relying on structured strategies, disciplined planning, and data-driven tools like a brokerage calculator, you can make the right choices that align with your financial objectives.

You can also consider platforms like Ventura, offering brokerage calculators that simplify the trading process, helping you focus on maximising returns and minimising risks. If you’re ready to take the next step, explore trading platforms that combine advanced tools and real-time insights to elevate your trading experience.