HCL Technologies, established in 1976, is a leading global IT services and consulting company headquartered in Noida, India. With a strong presence in over 50 countries, HCL specializes in various domains, including IT services, consulting, and business process outsourcing (BPO). The company is known for its innovative solutions and strategic partnerships, which have significantly contributed to its growth and market positioning.

Share price is a crucial indicator of a company’s market performance and investor confidence. It reflects the company’s financial health, growth prospects, and overall market sentiment. For investors, tracking share price trends is essential for making informed investment decisions and assessing the company’s potential for future returns.

Historical Performance of HCL Tech Share Price

Early Years and Initial Public Offering (IPO)

HCL Technologies made its initial public offering (IPO) in 1999, marking a significant milestone in its journey. The IPO allowed the company to raise capital for expansion and investment in new technologies. In the early years, HCL’s share price experienced fluctuations, reflecting market conditions and the company’s evolving business strategy.

Growth Phase and Market Expansion

The mid-2000s witnessed a period of robust growth for HCL Technologies. The company expanded its service offerings and established a strong foothold in international markets. During this phase, the share price saw an upward trajectory, driven by increased revenues, strategic acquisitions, and a growing client base.

Challenges and Market Corrections

Like many technology companies, HCL Technologies faced challenges during the global financial crisis of 2008. The share price experienced a downturn as market sentiment shifted and investor confidence wavered. However, the company navigated these challenges by focusing on cost optimization and strengthening its core competencies.

Recent Trends and Performance

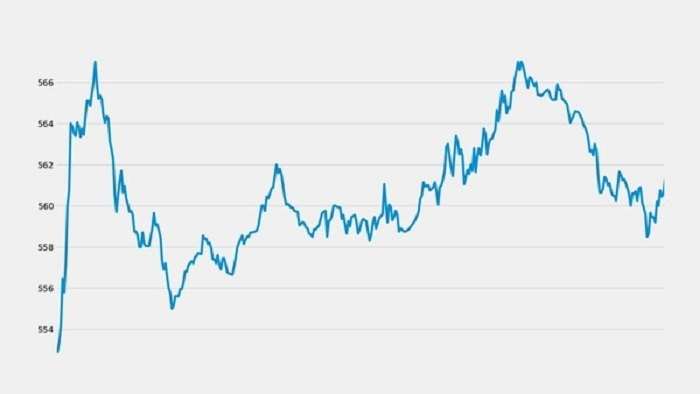

In recent years, HCL Technologies has demonstrated resilience and adaptability. The company’s share price has reflected its steady growth trajectory, driven by its focus on digital transformation, cloud computing, and emerging technologies. Recent market trends have shown a positive outlook for HCL, with its share price reaching new highs.

Key Drivers Influencing HCL Tech Share Price

Financial Performance and Earnings Reports

HCL Technologies’ financial performance is a critical factor influencing its share price. Investors closely analyze earnings reports, revenue growth, profit margins, and other key financial metrics. Positive financial results often lead to an increase in share price, while disappointing earnings can result in declines.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a significant role in shaping HCL Technologies’ growth prospects. Collaborations with industry leaders and acquisitions of complementary businesses enhance the company’s market position and expand its service offerings. Such developments often have a positive impact on the share price.

Market Sentiment and Economic Conditions

Market sentiment and broader economic conditions influence investor perceptions and, consequently, the share price of HCL Technologies. Economic stability, industry trends, and geopolitical factors can affect investor confidence and impact the company’s stock performance.

Technological Innovations and Industry Trends

HCL Technologies’ focus on technological innovations and industry trends contributes to its competitive edge. Investments in emerging technologies, such as artificial intelligence, cybersecurity, and cloud computing, align with market demands and enhance the company’s growth potential. Positive developments in these areas can drive share price appreciation.

Future Outlook for HCL Tech Share Price

Growth Prospects and Strategic Initiatives

HCL Technologies’ future outlook is closely tied to its growth prospects and strategic initiatives. The company’s emphasis on digital transformation, expanding its service portfolio, and entering new markets positions it for continued success. Analysts and investors will closely monitor these initiatives to gauge their impact on the share price.

Market Trends and Industry Forecasts

Market trends and industry forecasts provide valuable insights into the future performance of HCL Technologies. Analysts assess factors such as industry growth, technological advancements, and competitive dynamics to predict share price trends. Staying informed about these trends is essential for making informed investment decisions.

Risk Factors and Challenges

While HCL Technologies shows promise, it is not immune to risks and challenges. Factors such as regulatory changes, geopolitical tensions, and market competition can pose risks to the company’s growth and share price stability. Investors should be aware of these potential challenges and their impact on the company’s stock performance.

Related Post:

Discovering the Heartbeat of Harare

Celebrating National Sports Day

HCL Technologies’ share price reflects a complex interplay of factors, including historical performance, financial metrics, strategic initiatives, and broader market conditions. As a prominent player in the IT services industry, HCL’s share price trends provide valuable insights into its growth trajectory and market positioning. Investors and analysts must stay informed about the company’s performance, industry developments, and economic factors to make informed decisions and navigate the dynamic landscape of HCL Tech’s share price.

In summary, HCL Technologies continues to be a significant player in the global IT services sector, and its share price remains a key indicator of its market performance and growth potential. By analyzing historical trends, key drivers, and future outlook, investors can gain a comprehensive understanding of HCL Tech’s share price dynamics and make informed investment decisions.