Overview of Zee Entertainment Enterprises Limited (ZEEL)

Zee Entertainment Enterprises Limited, a subsidiary of the Essel Group, is one of India’s leading media conglomerates. Launched in 1992, the company has grown exponentially, establishing a solid footprint in both national and international markets. Zee operates several television channels across genres like general entertainment, news, movies, and regional content, making it one of the most widely watched networks in the country.

Zee’s digital presence has also surged in recent years, with platforms like Zee5 offering a wide range of movies, TV shows, and original content. This expansion has played a crucial role in increasing Zee’s market share, allowing it to adapt to the changing dynamics of media consumption.

Stock Market Overview of Zee Entertainment

Zee Entertainment is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), making it accessible to a vast number of investors. Over the years, its stock has attracted a mix of long-term investors and short-term traders, making it a subject of significant trading volume and volatility at times.

The Zee Entertainment share has been both rewarding and challenging for investors. Like many stocks in the entertainment sector, Zee’s share price tends to be influenced by several external and internal factors. While the stock has seen robust growth in the past, there have been moments of sharp declines, primarily driven by operational issues, leadership changes, and market sentiment.

Key Factors Influencing Zee Entertainment Share Price

Investors looking to invest in Zee Entertainment shares should consider a variety of factors that influence the stock’s performance. These factors can provide insight into potential future movements in share price and guide informed investment decisions.

Growth in Media and Entertainment Industry

One of the primary factors that affect Zee Entertainment’s stock price is the overall growth and performance of the media and entertainment industry. With the rise of digital streaming platforms, changing viewer habits, and an increased focus on content, the media landscape is evolving rapidly. Zee’s ability to adapt and compete in this shifting environment impacts its stock performance.

For instance, the company’s digital platform, Zee5, has emerged as a strong contender in the Indian OTT space. As more consumers shift towards streaming services, Zee5’s success will be crucial to the long-term growth of Zee Entertainment’s stock.

Advertising Revenue

The advertising revenue generated by Zee Entertainment is a key driver of its overall profitability and, subsequently, its share price. A significant portion of Zee’s earnings comes from advertising, which is heavily influenced by factors such as viewership ratings, market conditions, and advertising budgets.

Any downturn in advertising revenue, either due to economic slowdowns or shifts in the advertising landscape, can put downward pressure on Zee’s share price. Conversely, an increase in advertising revenue, especially in prime entertainment categories, can boost the stock’s value.

Content Creation and Acquisition

The quality and diversity of content offered by Zee Entertainment play a significant role in determining its viewership and revenue. Zee has a history of producing and acquiring successful content across genres. This includes hit television shows, movies, and original web series that attract millions of viewers.

An increased investment in content creation or acquisition can lead to higher viewership, which directly impacts advertising revenue and subscription growth for Zee5. Content that resonates well with audiences enhances Zee’s overall market position, positively impacting the share price.

Operational Performance and Profitability

Like any publicly traded company, Zee’s operational performance and profitability are key determinants of its stock price. Investors closely watch Zee’s quarterly earnings reports, profit margins, and financial metrics like return on equity (ROE) and return on assets (ROA). Strong financial performance tends to drive stock prices higher, while underperformance or negative surprises can lead to sharp declines in the stock.

Corporate Governance and Leadership

Corporate governance has been a significant topic of discussion concerning Zee Entertainment in recent years. Leadership changes, boardroom struggles, and issues surrounding governance can create uncertainty among investors. These concerns may cause fluctuations in Zee’s stock price, especially when there is perceived instability in management.

The resolution of governance-related issues and a clear direction for leadership can restore investor confidence and lead to a rebound in Zee Entertainment’s stock.

Economic and Market Conditions

Broader economic and market conditions also influence the share price of Zee Entertainment. In times of economic downturn, advertising budgets tend to shrink, impacting the media and entertainment sector. Additionally, changes in interest rates, inflation, and consumer spending can create volatility in Zee’s share price.

Similarly, global events like the COVID-19 pandemic had a profound impact on the entertainment industry, disrupting production schedules, viewership patterns, and advertising revenues. Such unforeseen events can lead to fluctuations in the stock.

Competitor Performance

Zee Entertainment operates in a highly competitive environment, facing competition from other media giants like Sony Pictures Networks, Star India, and Viacom18. The performance of these competitors, particularly in the digital streaming space, can affect Zee’s market share and stock price.

For example, if a competitor like Netflix or Amazon Prime Video launches a new, popular series, it may lead to a dip in Zee’s viewership and advertising revenue, which could negatively impact its share price. On the other hand, Zee’s ability to outperform its competitors can enhance its position in the market and drive up its stock.

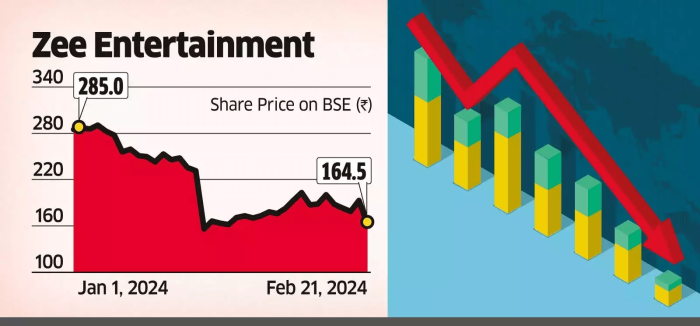

Historical Performance of Zee Entertainment Share

Zee Entertainment shares have witnessed a dynamic performance over the years, with periods of strong growth followed by phases of volatility. Understanding the historical performance of the stock can provide insights into the factors that have shaped its movement.

Initial Public Offering (IPO) and Early Years

Zee Entertainment made its debut on the stock market in 1992. In its early years, the stock saw steady growth, largely due to the company’s pioneering role in the Indian television market. As one of the first private broadcasters in India, Zee’s programming quickly gained popularity, and its financial performance reflected this success.

Growth Phase

During the 2000s and early 2010s, Zee Entertainment experienced a significant growth phase. The expansion of its television channels across multiple genres, coupled with the rise of satellite television in India, contributed to this growth. Investors were bullish on the stock as Zee consistently reported strong earnings, which pushed its share price upward.

Period of Volatility

In recent years, Zee Entertainment shares have experienced heightened volatility. Several factors have contributed to this, including corporate governance concerns, changes in leadership, and market competition. The stock saw a sharp decline in 2019 due to allegations of governance issues and financial irregularities, leading to a loss of investor confidence.

However, Zee has made efforts to recover from these challenges by restructuring its management, improving transparency, and focusing on growth through digital platforms.

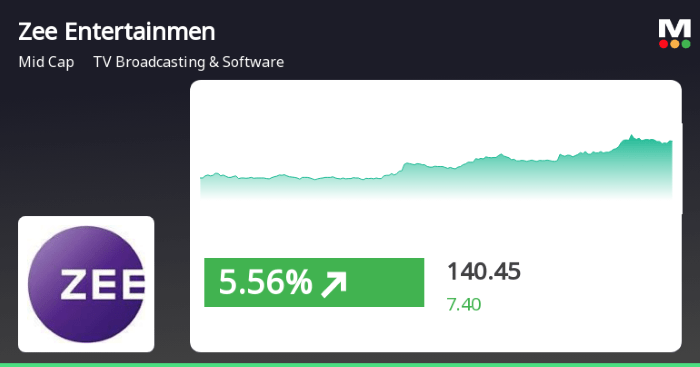

Current Trends

In the post-pandemic era, Zee Entertainment has focused on strengthening its digital presence and content library. Zee5, the company’s digital streaming platform, has become a central part of its strategy, and investors are optimistic about the potential of the OTT market in India.

While the stock has shown signs of recovery, it remains subject to the broader dynamics of the media industry and the company’s ability to navigate challenges like competition and evolving consumer preferences.

Future Prospects for Zee Entertainment Share

Looking ahead, several factors could shape the future trajectory of Zee Entertainment’s share price.

Growth of Digital Streaming

The rise of digital streaming platforms presents a major growth opportunity for Zee Entertainment. As more viewers transition from traditional TV to streaming services, Zee5 is positioned to capture a significant share of this growing market. Continued investment in original content and partnerships with global media companies could further enhance Zee5’s appeal and drive growth in subscriptions and advertising revenue.

Potential Mergers and Acquisitions

In recent years, there have been rumors of potential mergers and acquisitions involving Zee Entertainment. Such developments could create significant value for shareholders, depending on the terms of the deal. A strategic partnership or merger with another media giant could strengthen Zee’s competitive position in the market.

Improving Corporate Governance

Zee has taken steps to address its corporate governance issues, which have been a concern for investors. By improving transparency, accountability, and leadership, Zee can rebuild investor trust and attract long-term institutional investors, which could positively impact its stock price.

Related Post:

Zee Entertainment share has been a rollercoaster for investors, offering periods of substantial growth as well as challenges. As a major player in the Indian media industry, Zee Entertainment continues to be an attractive stock for those looking to invest in the media and entertainment sector. Factors like the growth of digital streaming, operational performance, and corporate governance will continue to influence the stock’s performance in the future. Investors should keep a close eye on Zee’s evolving strategy, market trends, and broader economic conditions to make informed decisions regarding its shares.