Understanding Zee Entertainment’s Market Position

The Evolution of Zee Entertainment

Founded in 1992 by Subhash Chandra, Zee Entertainment has grown into a major player in the Indian media landscape. The company operates a diverse range of television channels in various languages, including Hindi, Tamil, Telugu, and Kannada. Additionally, Zee Entertainment has expanded its reach into the film industry and digital streaming platforms, further solidifying its position in the market.

Key Business Segments

Zee Entertainment’s business can be broadly categorized into three main segments:

- Television Broadcasting: Zee’s extensive network of television channels, including Zee TV, Zee Cinema, and Zee News, caters to a wide audience across India and internationally.

- Film Production and Distribution: The company is involved in the production and distribution of films, contributing to its revenue stream and market presence.

- Digital Media: With the advent of digital media, Zee has made significant strides in the online streaming space through its platforms like ZEE5, which offers a vast library of content to subscribers.

Factors Influencing Zee Entertainment’s Share Price

Market Sentiment and Investor Perception

The share price of Zee Entertainment is heavily influenced by market sentiment and investor perception. Positive news about the company’s performance, new content launches, or strategic partnerships can lead to a rise in share price. Conversely, negative news or poor financial performance can result in a decline. Understanding investor sentiment is crucial for predicting future movements in the share price.

Financial Performance and Earnings Reports

Financial performance plays a critical role in determining Zee Entertainment’s share price. Key metrics such as revenue growth, profit margins, and earnings per share (EPS) provide insights into the company’s financial health. Investors closely monitor quarterly and annual earnings reports to assess the company’s performance and make informed decisions.

Industry Trends and Competition

The media and entertainment industry is highly competitive, with numerous players vying for market share. Zee Entertainment faces competition from other major media companies, both in television broadcasting and digital streaming. Industry trends, such as the shift towards digital content consumption and changing viewer preferences, can impact Zee’s market position and, consequently, its share price.

Regulatory Changes and Policy Impact

Regulatory changes and government policies can significantly affect Zee Entertainment’s operations and share price. For instance, changes in broadcasting regulations, foreign investment policies, or taxation laws can impact the company’s financial performance and investor confidence.

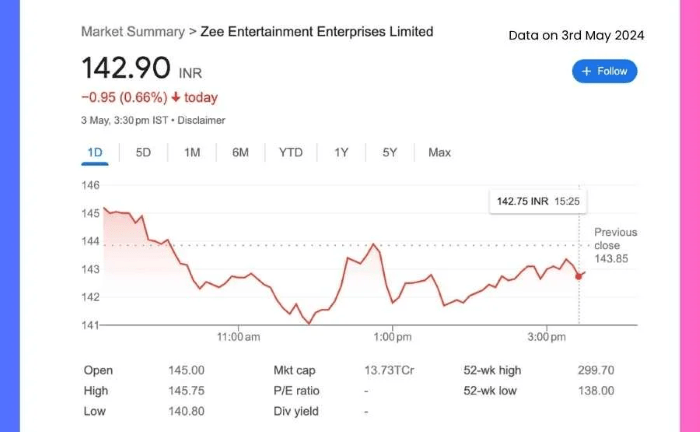

Current Trends in Zee Entertainment’s Share Price

Recent Performance Overview

As of the latest available data, Zee Entertainment’s share price has experienced fluctuations due to various internal and external factors. Analyzing recent performance trends helps in understanding the current market dynamics and the factors driving share price movements.

Impact of Corporate Developments

Corporate developments, such as mergers, acquisitions, or strategic partnerships, can influence Zee Entertainment’s share price. For instance, any announcements regarding collaboration with international media companies or expansion into new markets may lead to a positive response from investors.

Technological Advancements and Digital Strategy

Zee Entertainment’s investment in technology and digital strategy plays a crucial role in its market performance. The company’s focus on enhancing its digital platforms, such as ZEE5, and adopting new technologies can impact its share price by attracting more subscribers and increasing revenue.

Future Outlook for Zee Entertainment’s Share Price

Growth Prospects and Strategic Initiatives

Looking ahead, Zee Entertainment’s share price will be influenced by its growth prospects and strategic initiatives. The company’s plans for expanding its content portfolio, entering new markets, and leveraging emerging technologies will be key factors in driving future performance.

Economic and Market Conditions

The broader economic and market conditions also play a significant role in shaping Zee Entertainment’s share price. Factors such as economic growth, inflation rates, and market volatility can impact investor sentiment and stock performance.

Analyst Predictions and Investment Recommendations

Analysts and investment experts provide valuable insights and predictions regarding Zee Entertainment’s share price. By analyzing market trends, financial data, and company performance, analysts offer recommendations on whether to buy, hold, or sell shares in Zee Entertainment.

Related Post:

Zee Entertainment’s share price is influenced by a myriad of factors, including market sentiment, financial performance, industry trends, and regulatory changes. By understanding these factors and keeping abreast of current trends and future outlooks, investors can make informed decisions about their investments in Zee Entertainment. As the company continues to evolve and adapt to the changing media landscape, its share price will remain a focal point for market participants and industry observers.